Table of Contents

- The Ultimate Pre Market Trading Guide For Beginners - YouTube

- Premarket Trading: How it Works, Hours & Key Market Movers - DTTW™

- What Is Pre-market Trading And Its Advantages?

- how does pre-market trading work

- Pre market trading - trading before market open - BeDayTrader.com

- Best Brokers For Pre-Market/After-Hours Trading (2022)

- Pre-market Trading - An In-Depth Guide for Traders

- Pre-Market Trading: How It Works, Benefits, and Risks

- How to Benefit from Futures for Premarket Trading? - DTTW™

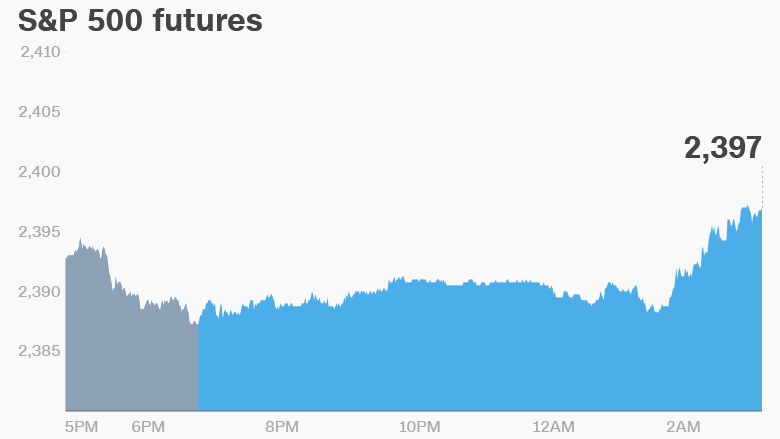

- Premarket: 5 things to know before the bell

Understanding Pre-Market Trading

:max_bytes(150000):strip_icc()/premarket.asp-final-cac4cee899af4acc8537ba1d6df84bbd.png)

Factors Influencing Pre-Market Trends

Leveraging Pre-Market Data for Investment Decisions

Investors can utilize pre-market data to gauge potential market movements and make strategic decisions: - Identifying Trends: Monitoring pre-market activity can help in identifying early trends that may continue into the regular trading session. - Risk Management: Understanding pre-market volatility can aid in setting appropriate stop-loss levels and managing risk. - Opportunity Identification: Pre-market trading can reveal opportunities for buying or selling stocks based on after-hours earnings reports or news releases.

Tools and Resources for Pre-Market Analysis

Several tools and resources are available to help investors analyze pre-market trends: - Financial News Websites: Sites like Bloomberg, CNBC, and Reuters provide real-time news and analysis. - Stock Screeners: Tools that filter stocks based on specific criteria, including pre-market movers. - Trading Platforms: Many platforms offer extended-hours trading capabilities and real-time data.

For the latest updates and insights on pre-market trends and stock market analysis, visit our website or subscribe to our newsletter to stay ahead of the curve.

Stay informed, invest wisely.